AI Implementation Roadmap for Insurance

Your step-by-step guide to operational excellence. Build AI capabilities progressively through four proven phases—from data extraction to predictive analytics.

The Decision Fatigue Problem

Insurance executives face unprecedented complexity: regulatory compliance, risk management, innovation pressure, and operational continuity. Adding AI implementation decisions to this burden can cause paralysis.

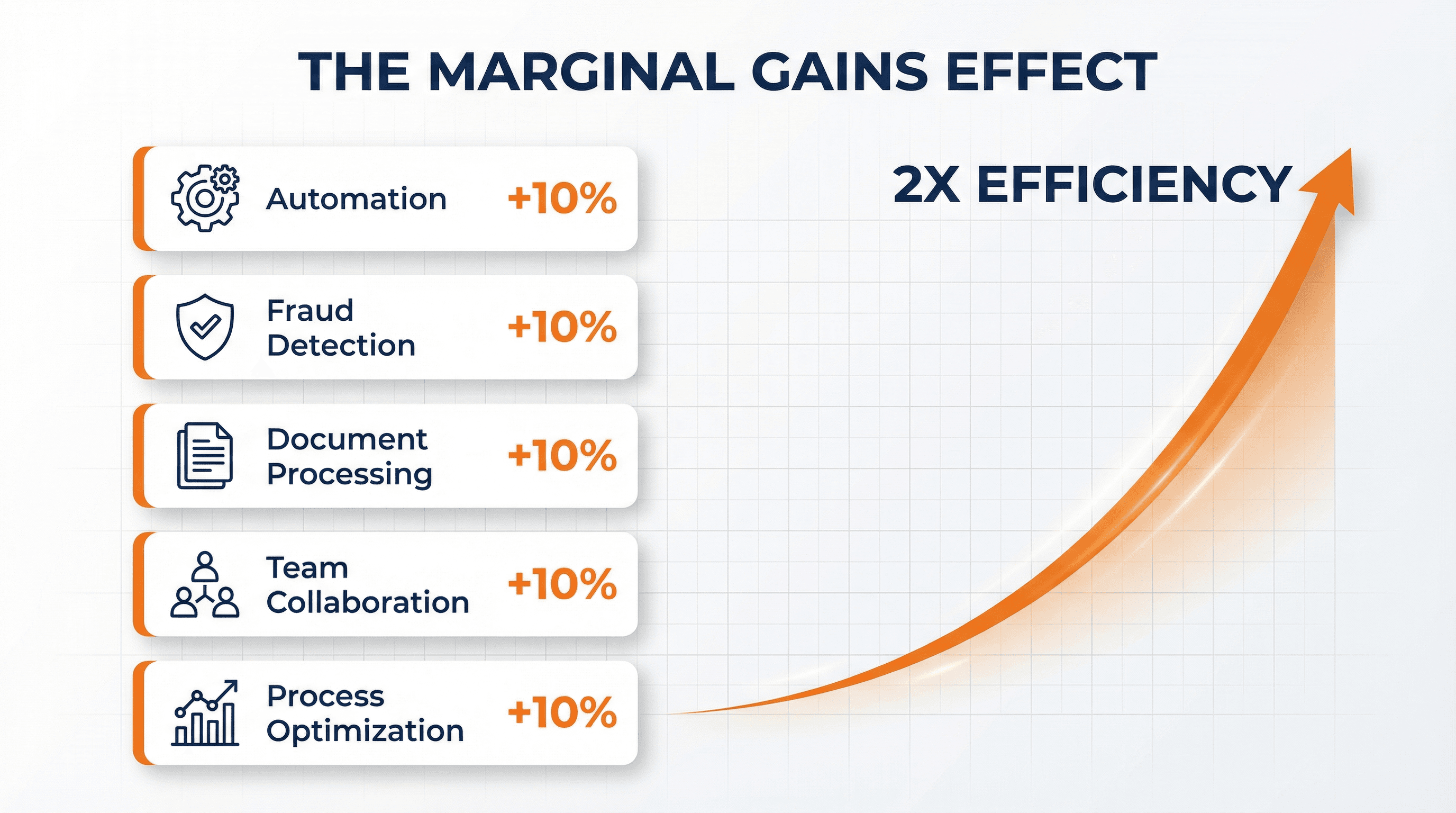

The solution: Don't pursue perfect implementation. Focus on systematic progress through incremental, measurable improvements—the marginal gains philosophy.

The Marginal Gains Philosophy

British Cycling transformed from mediocrity to dominance by pursuing 1% improvements in every area—bike design, nutrition, sleep quality, hand-washing protocols. The compound effect was extraordinary: five Tour de France victories and 66 Olympic gold medals in a decade.

The Compound Effect Formula:

(1.01)365 = 37.8×

1% daily improvement compounds to 37.8× improvement over one year

Applied to insurance: Rather than pursuing comprehensive system overhauls, successful organizations build AI capabilities progressively. Each phase delivers measurable value while preparing your team for the next level of sophistication.

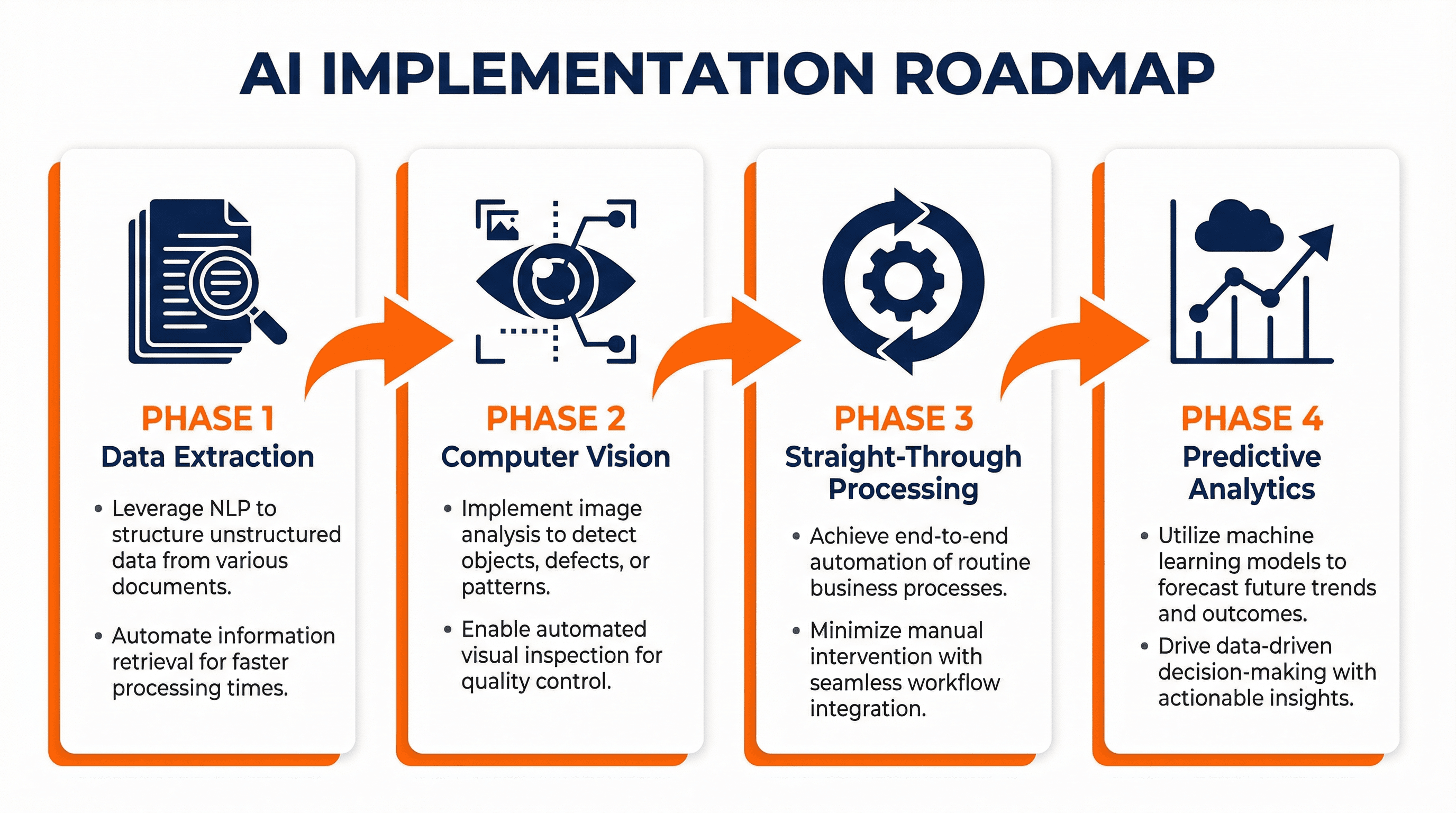

Your 4-Phase Implementation Roadmap

Phase 1: Automated Data Extraction

Extract structured data from unstructured documents

🎯 What You'll Achieve:

Transform claims forms, policy documents, and medical records into structured data automatically—reducing manual data entry by 60-75%.

Common Use Cases

- Claims Forms: Extract loss date, location, parties, damages from FNOL documents

- Policy Documents: Identify coverage limits, exclusions, endorsements

- Medical Records: Summarize treatment history, diagnoses, prognosis

60-75%

Time Reduction

95-98%

Accuracy Rate

40-60%

Cost Reduction

Quick Win: Start with ACORD forms—they're standardized, high-volume, and deliver immediate ROI.

Phase 2: Computer Vision for Damage Assessment

AI analyzes photos and videos to assess damage automatically

🎯 What You'll Achieve:

Generate damage estimates from photos in under 2 minutes—saving adjusters 30-40% of inspection time while improving consistency.

Common Use Cases

- Auto Claims: Identify damaged parts, estimate repair costs from photos

- Property Claims: Detect roof damage, structural issues, water intrusion

- Fraud Detection: Spot inconsistencies between photos and damage descriptions

±10%

Estimate Accuracy

<2 min

Time to Estimate

30-40%

Time Saved

Quick Win: Start with simple auto damage (dents, scratches, windshield cracks)—easier to detect and estimate than complex structural damage.

Phase 3: Straight-Through Processing (STP)

End-to-end automation for low-complexity claims

🎯 What You'll Achieve:

Automate 30-50% of claims from FNOL to payment—processing in under 24 hours with <2% error rate.

Common Use Cases

- Auto Glass Replacement: Binary decision (covered/not covered), standard pricing

- Minor Property Claims: <$5K, no liability disputes, clear coverage

- Standard Medical Bills: Pre-approved procedures, in-network providers

30-50%

STP Rate

<24h

Processing Time

<2%

Error Rate

Quick Win: Windshield claims are ideal for STP—binary coverage decision, standard pricing, high volume.

Phase 4: Predictive Analytics

Forecast outcomes, identify patterns, optimize decisions

🎯 What You'll Achieve:

Predict fraud, subrogation potential, reserve adequacy, and churn risk with 80-90% accuracy—delivering 3-5× ROI within 12 months.

Common Use Cases

- Fraud Likelihood Scoring: Flag suspicious claims for investigation

- Subrogation Potential: Predict recovery likelihood and prioritize cases

- Reserve Adequacy: Forecast ultimate claim costs more accurately

- Customer Churn Prevention: Identify at-risk policyholders before renewal

80-90%

Prediction Accuracy

<10%

False Positive Rate

3-5×

ROI (12 months)

Quick Win: Fraud detection delivers highest ROI—every prevented fraud pays for the entire AI investment.

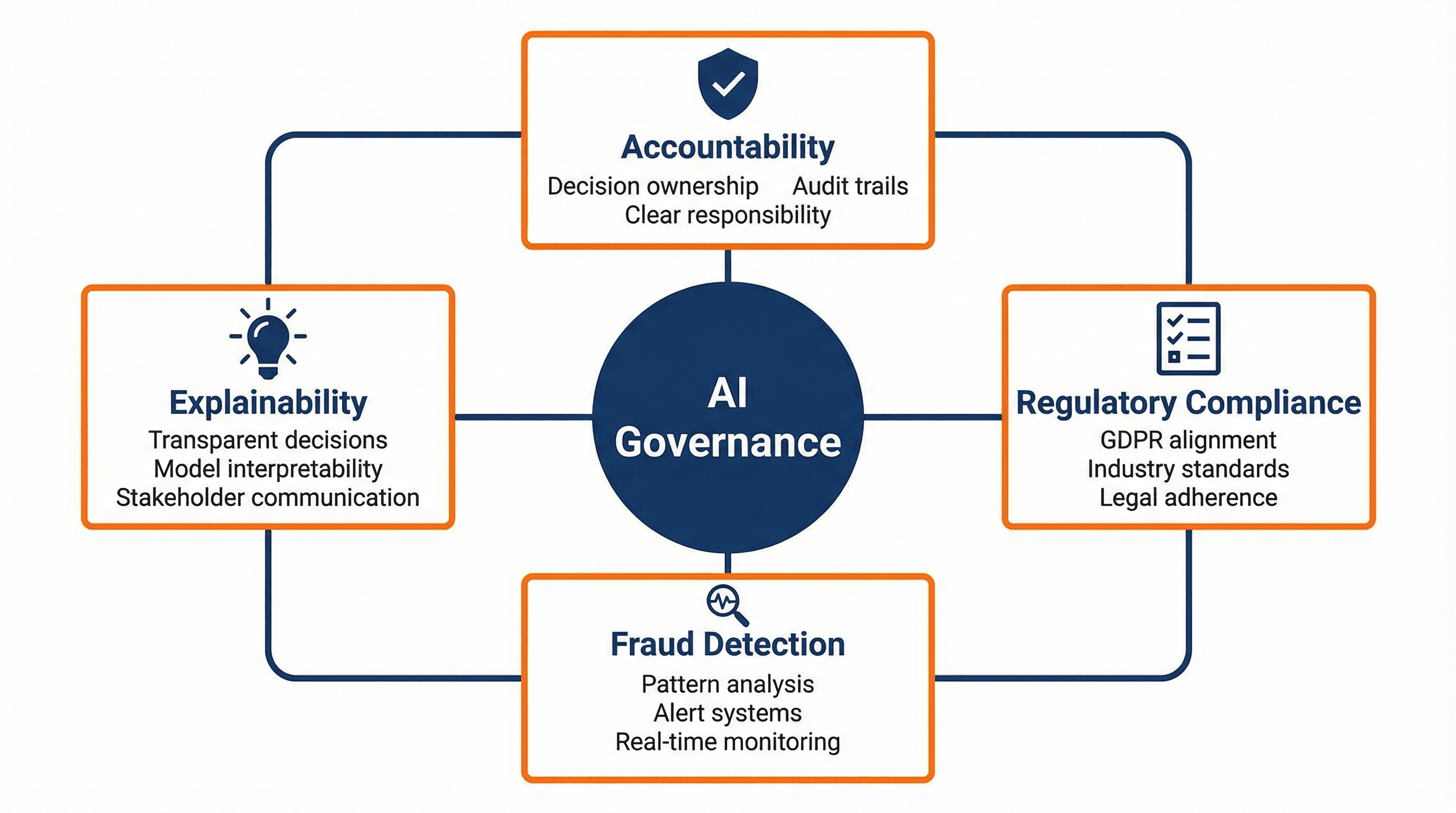

Governance Framework: The Four Pillars

As you scale AI across your organization, establish governance guardrails to ensure accountability, compliance, fraud detection, and explainability. These four pillars protect your organization while enabling innovation.

Governance Implementation Checklist

- Establish AI ethics committee with cross-functional representation

- Document model decision logic and maintain audit trails

- Train staff on AI governance, bias monitoring, and escalation procedures

- Set up bias monitoring dashboards and quarterly reviews

- Define clear escalation paths for AI-flagged edge cases

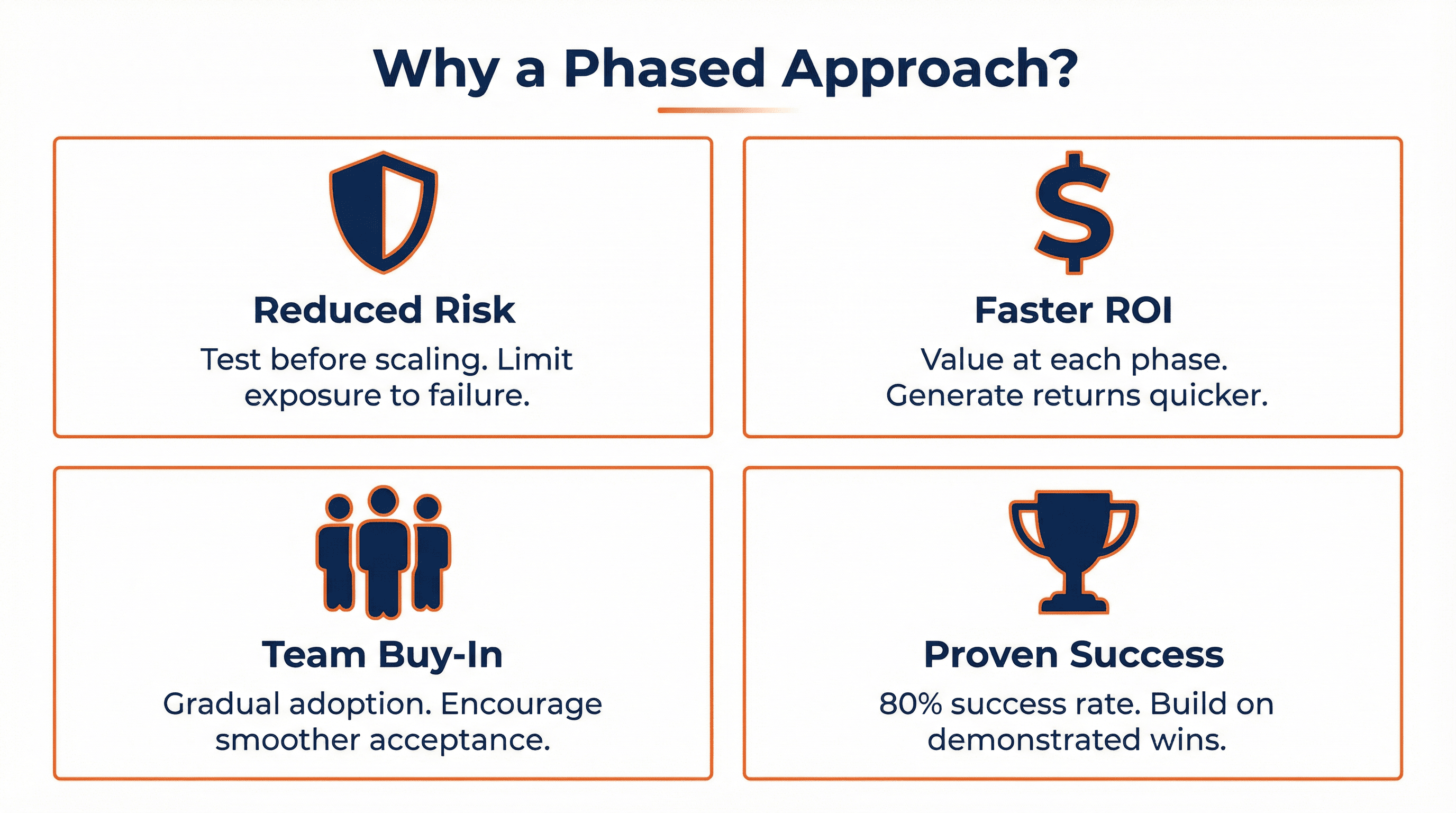

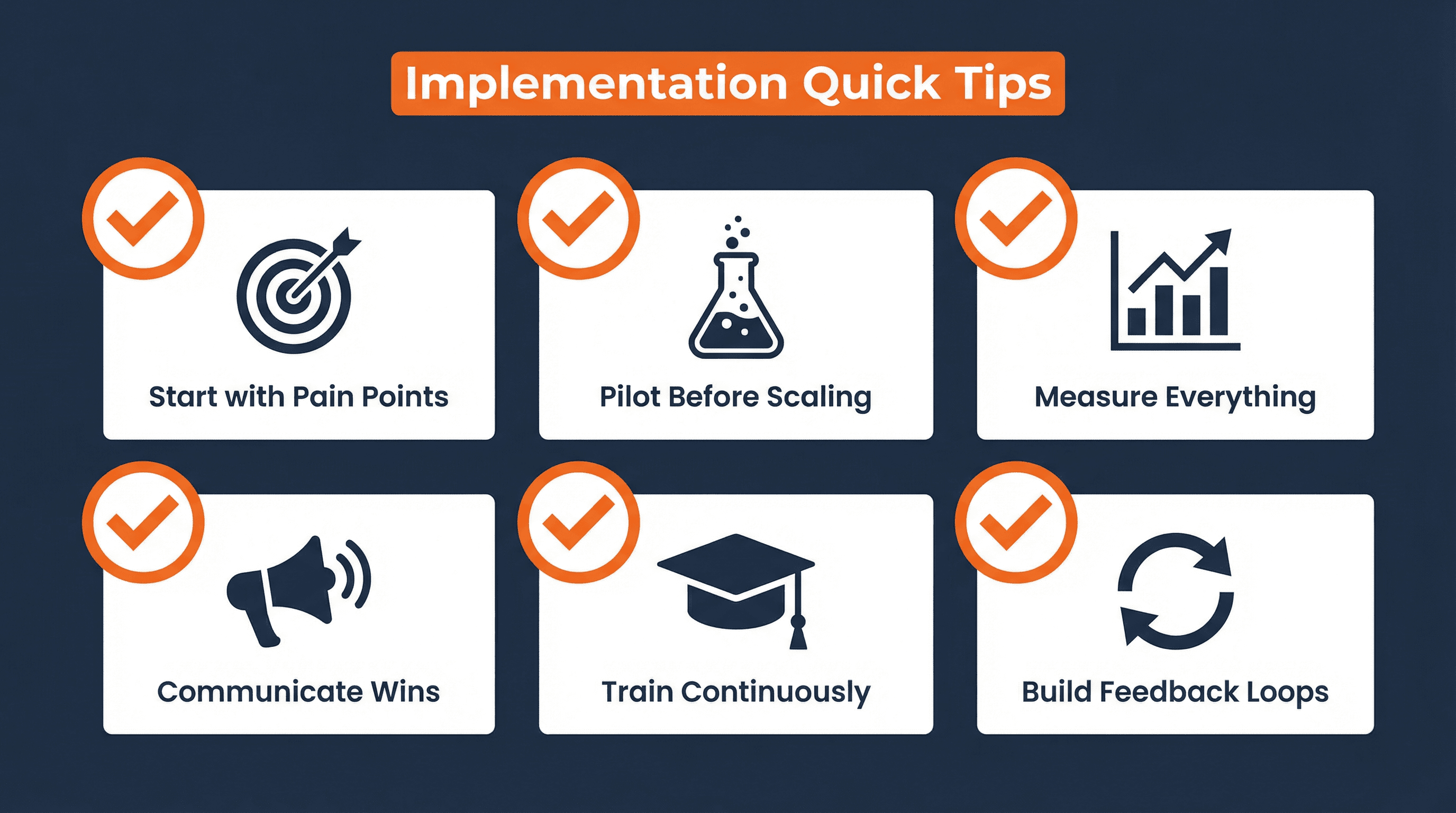

Change Management: Building Team Buy-In

Common Challenges

- •Staff resistance to automation

- •Fear of job displacement

- •Learning curve for new tools

- •Skepticism about AI accuracy

Proven Solutions

- Position AI as "augmentation not replacement"

- Involve staff in pilot design and feedback

- Celebrate early wins publicly

- Provide hands-on training and support

- Create AI champions program

Key Takeaways

Start Small

Phase 1 (data extraction) delivers quick wins and builds momentum

Measure Relentlessly

Track accuracy, time, and cost at each phase to prove ROI

Build Capability

Each phase prepares your team for the next level of sophistication

Govern Proactively

Establish guardrails before scaling to ensure accountability and compliance

Ready to start your AI implementation journey?

Get in Touch