Actions

AI Implementation Guide for Insurance

From Decision Fatigue to Operational Excellence

From Decision Fatigue to Operational Excellence

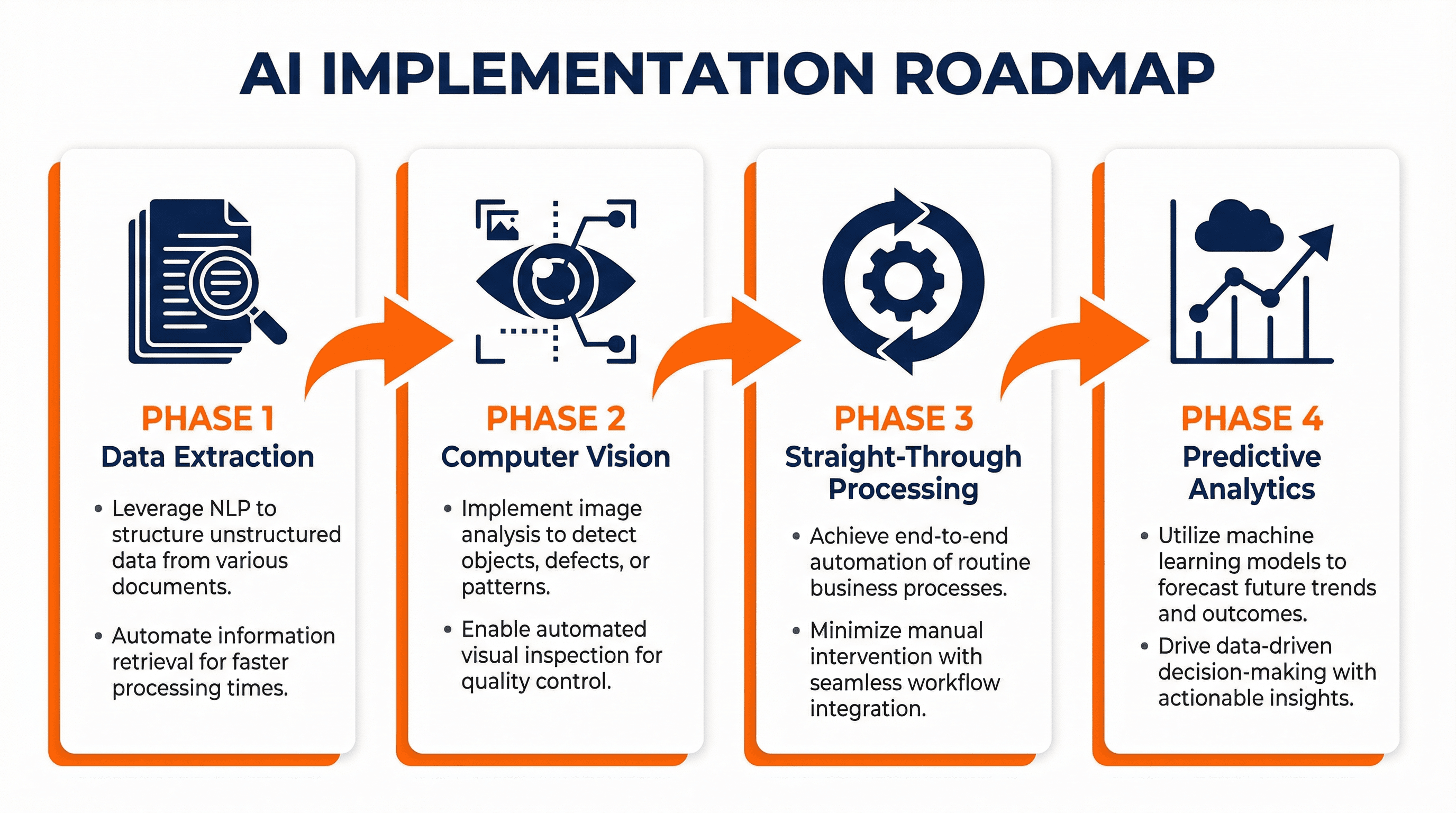

Insurance executives face unprecedented decision complexity as AI transforms operational possibilities. This guide provides a systematic, four-phase implementation roadmap grounded in the marginal gains philosophy: achieving transformational results through incremental, measurable improvements.

Rather than pursuing comprehensive system overhauls, successful organizations build AI capabilities progressively—starting with automated data extraction, advancing through computer vision and straight-through processing, and culminating in predictive analytics. This approach reduces risk, builds organizational capability, and delivers measurable value at each stage.

96%

Accuracy in automated processing

65%

Automation potential identified

75%

Time reduction in processing

4

Phases to full implementation

Overcoming Executive Decision Fatigue

Executive decision fatigue is a critical challenge facing insurance leaders today. The industry presents a complex array of simultaneous demands: regulatory compliance, risk management, innovation pressure, and operational continuity. When AI implementation decisions are added to this already substantial burden, the cognitive load can become overwhelming.

Insurance executives face high-stakes choices while technology evolves at an unprecedented pace. Your customers demand immediate service: faster claims processing, seamless digital experiences, and real-time updates. However, internal systems and team capacity often cannot deliver on these expectations. This creates a challenging cycle where you must make rapid AI investment decisions while managing the gap between customer expectations and organizational capability.

The complexity intensifies when you consider that every AI decision simultaneously impacts regulatory compliance, operational risk, and competitive positioning. Leaders can become paralyzed by the imperative to achieve perfect implementation rather than initiating progress with measured steps.

"The goal is not perfect implementation—it's systematic progress that reduces cognitive load while building organizational capability."

Structured Decision Frameworks

Successful AI adoption requires substantial executive involvement, but this engagement need not be overwhelming. The key lies in structuring decisions to reduce cognitive load rather than compounding it.

Strategic organizations conduct profit and loss scenario exercises to identify where AI creates the greatest competitive advantage. This approach provides clear evaluation frameworks instead of forcing gut decisions based on incomplete information. When you can examine concrete numbers—potential cost savings, efficiency gains, customer satisfaction improvements—the optimal path forward becomes evident.

The most sophisticated AI solution delivers no value if your team resists using it. AI should not replace your people; it should elevate good professionals to great and great professionals to exceptional. Design AI as a collaborator, not a controller. The technology should offer intelligent recommendations that streamline processes without undermining the deep domain expertise your professionals bring to their roles.

The Power of Marginal Gains

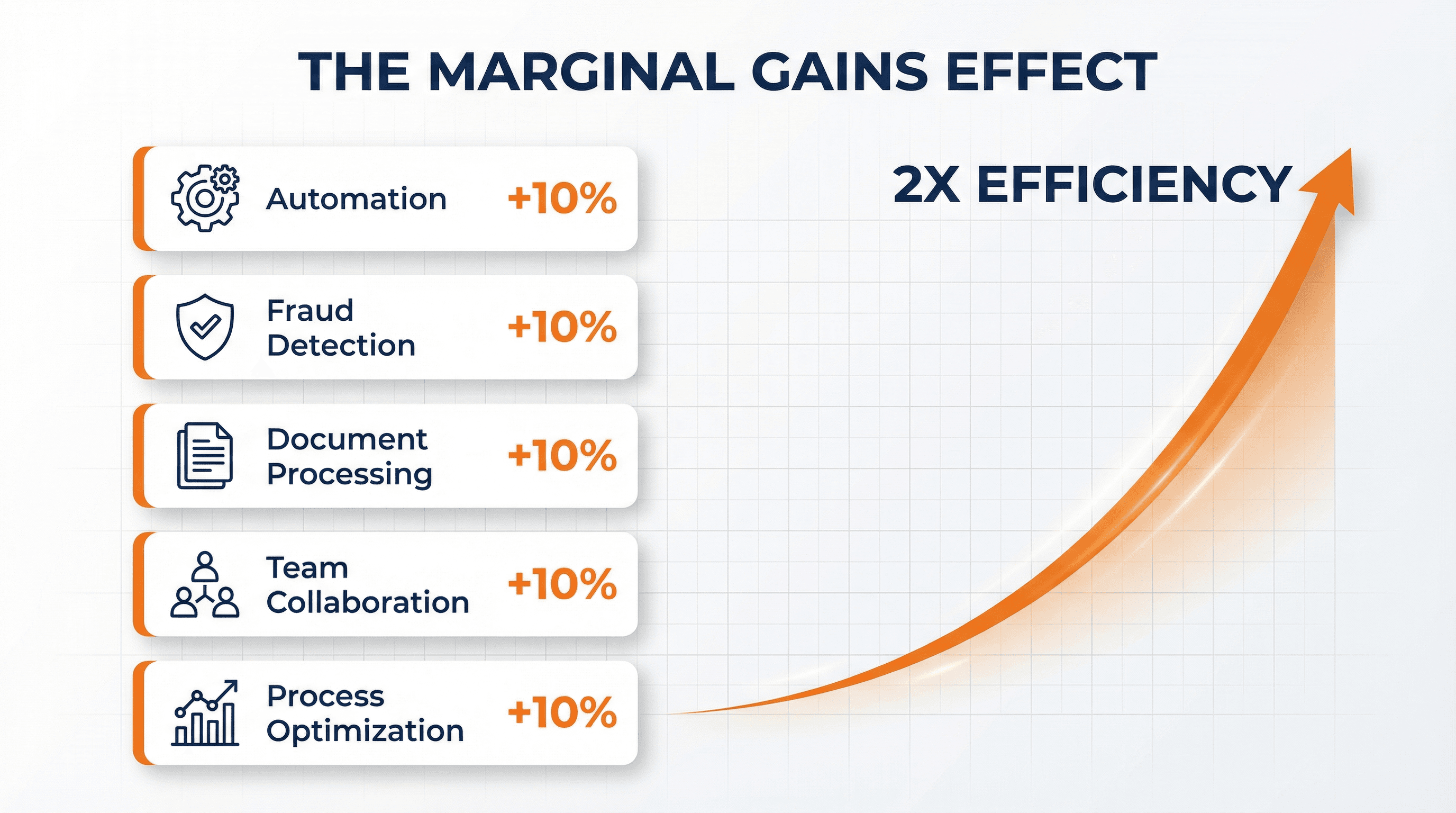

Transformational results emerge from incremental improvements. This principle, known as marginal gains, demonstrates that small enhancements across multiple dimensions compound to create substantial competitive advantages.

British Cycling exemplifies this philosophy. Rather than revolutionary changes, they optimized every element: ergonomic improvements to bike seats, aerodynamic refinements to clothing, even sleep quality through pillow selection. Each individual change represented perhaps a 1% improvement, yet collectively these marginal gains enabled Olympic dominance for over a decade.

Insurance organizations can apply this same methodology to claims processing. Comprehensive system overhauls are expensive and risky. Instead, target specific pain points and address them systematically, one by one.

Strategic Starting Points

Automate routine administrative tasks: Implement RPA (robotic process automation) to handle repetitive paperwork including data entry, status updates, and basic eligibility verification. Organizations report processing time reductions of 75% through this approach. Your adjusters can focus on substantive problem-solving instead of entering identical information into multiple systems. Initial setup requires several weeks, but the return on investment is immediate and compounds over time.

Deploy AI-powered fraud detection: Machine learning algorithms analyze patterns across thousands of claims in seconds, flagging suspicious cases for human review. This augments rather than replaces adjusters, providing them with superior intelligence. Legitimate claims process faster because they are not delayed behind obviously fraudulent submissions awaiting manual review.

Implement intelligent document processing: OCR and NLP tools read and sort documents 60% faster than manual processing. More importantly, they automatically categorize and extract key data points. AXA achieved significant efficiency gains through this technology, but the more substantial benefit was error rate reduction—machines do not misread handwriting or overlook important details due to fatigue.

Cultivate continuous improvement culture: Engage teams in identifying incremental enhancements regularly. The professionals processing claims daily possess precise knowledge of where processes encounter friction. Perhaps it is waiting for medical records, or perhaps it is an approval step that consistently requires three days. Create accessible mechanisms for them to flag these issues and, critically, act on their suggestions.

The Compound Effect

These improvements create synergistic value. Faster document processing means adjusters spend less time searching for information, enabling them to handle more complex cases. Enhanced fraud detection allocates more resources to legitimate claims, improving response times across the board. When customers receive faster responses, they call less frequently, freeing capacity for people who genuinely need assistance.

The mathematics are straightforward yet powerful. Improving five different processes by 10% each does not yield 50% improvement. You achieve compounding returns that can double efficiency within a year.

The Compound Effect Formula

(1.10)⁵ = 1.61 → 61% improvement from five 10% gains

Four-Phase Implementation Roadmap

Deploying AI in insurance claims requires neither revolutionary transformation nor simple plug-and-play installation. You need a structured plan resilient to real-world challenges. The key is building on marginal gains with a systematic approach that scales methodically.

Phase 1: Foundation (Automated Data Extraction)

Avoid attempting comprehensive transformation on day one. Begin with automated data extraction: teaching computers to interpret documents such as police reports and medical records. Currently, your claims handlers likely spend approximately 30% of their time transferring information from one system to another. This represents expensive busywork that machines can execute better and faster.

NLP (natural language processing) tools extract critical information from unstructured documents automatically. Consider it analogous to having an exceptionally fast intern who never experiences fatigue and makes no transcription errors. The technology has matured sufficiently that you will observe results within weeks, not months.

Phase 2: Enhanced Assessment (Computer Vision)

Once document processing operates smoothly, integrate photo analysis capabilities. Modern AI can examine damage photos and assess them with 96% accuracy. This often exceeds human adjuster performance when working from low-resolution phone images. This does not mean eliminating your adjusters; it means they receive superior information faster and can concentrate on complex cases that genuinely require human judgment.

The primary advantage is velocity. What previously required days for initial assessment now occurs in minutes. Customers receive answers faster, and your team can manage higher volume without strain.

Phase 3: Full Automation (Straight-Through Processing)

This phase introduces straight-through processing for routine claims. Industry data indicates that over 65% of claims are sufficiently straightforward to handle completely automatically. Consider minor vehicle collisions with clear liability and standard repair costs.

This is not about wholesale human replacement. It is about enabling machines to handle predictable, routine matters so your professionals can tackle complex cases that genuinely matter. Some organizations now process simple claims instantly, and customers appreciate the speed dramatically.

Phase 4: Advanced Intelligence (Predictive Analytics)

With your foundation solid, you can layer predictive capabilities that anticipate issues before they become problems. This includes fraud prediction, customer satisfaction forecasting, and operational bottleneck identification. Advanced analytics transform your operation from reactive to proactive, identifying patterns and opportunities invisible to manual analysis.

Governance and Cultural Foundations

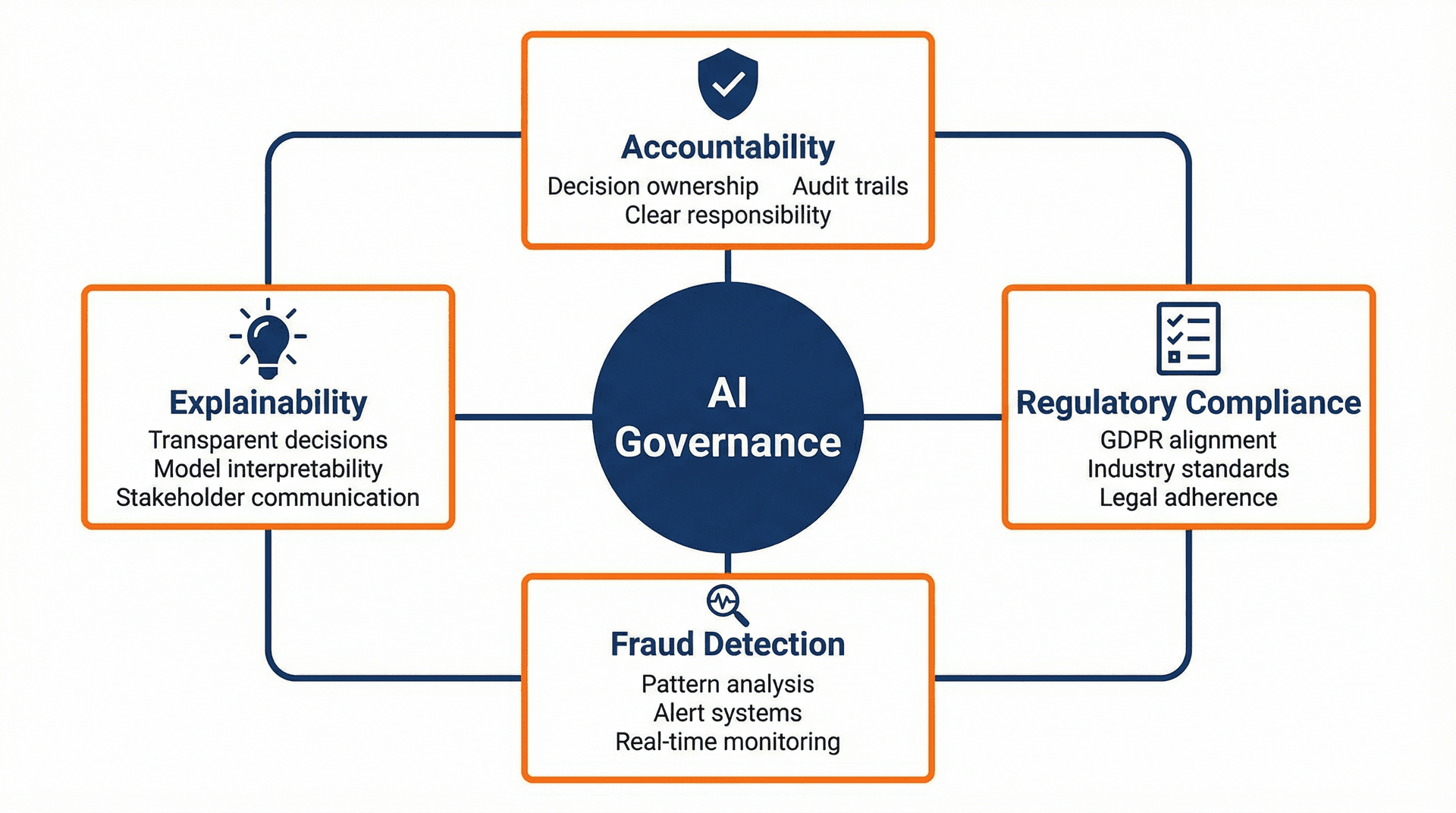

Essential Governance Framework

Governance may lack excitement, but this is where most AI projects fail. You need clear protocols addressing:

- Accountability when AI makes decisions

- Regulatory compliance maintenance (requirements are becoming stricter)

- Fraud detection using effective anomaly detection

- Decision explanation to customers and regulators

Establish these protocols at the outset, not after problems emerge.

Managing the Human Dimension

Your greatest challenge will not be the technology—it will be achieving adoption. Claims adjusters who have operated consistently for ten years will not embrace change overnight.

Invest in comprehensive training. Demonstrate how AI makes their jobs easier, not obsolete. The best implementations augment human expertise rather than replacing it. Your experienced adjusters become quality controllers and handle cases requiring genuine problem-solving skills.

Trust builds through measured implementations where AI proves its value without overstepping boundaries. When your team observes AI making their jobs easier rather than threatening their relevance, adoption becomes natural instead of forced.

Measuring What Matters

Do not measure processing speed exclusively (though it remains important). Also track customer satisfaction, accuracy rates, and time saved on routine tasks. Monitor the human factors: how frequently adjusters must redo work, how many times customers call requesting updates, how long new hires require to reach proficiency.

If metrics are not improving after one month, adjust your approach. The objective is freeing your intelligent professionals to perform intelligent work while machines handle repetitive tasks.

The Path Forward

Implementing AI successfully in insurance is not about revolutionary transformation. It is about thoughtful evolution. Start with small wins that build confidence and expertise. Use structured frameworks that reduce decision fatigue rather than adding to it. Focus on augmenting human capability rather than replacing it.

Organizations that master this approach will not merely improve their operations. They will build sustainable competitive advantages that compound over time. More importantly, they will create work environments where people and technology amplify each other's strengths, leading to better outcomes for employees, customers, and stakeholders alike.

The technology is ready. The question is whether your organization is prepared to implement it thoughtfully, systematically, and successfully.

Key Takeaways

Start with Foundation, Not Revolution

Begin with automated data extraction (Phase 1) to build confidence and capability before advancing to computer vision, straight-through processing, and predictive analytics.

Embrace Marginal Gains Philosophy

Five 10% improvements compound to 61% total improvement. Target specific pain points systematically rather than attempting comprehensive overhauls.

Establish Governance Before Scaling

Define accountability, compliance protocols, fraud detection mechanisms, and explainability standards at the outset—not after problems emerge.

Augment, Don't Replace

Design AI as a collaborator that makes good people great. Invest in training, demonstrate value, and let experienced professionals handle complex cases requiring genuine judgment.

References

- Agentech - Agentic AI in Insurance: When Bots Become Your Best Agents

- Agentech - AI Claims Processing System

- Amplework - AI for Insurance Agents: Claims, Risk & Customer Experience

- Appinventiv - AI in Insurance

- EY - Are You Ready for the Next Wave of AI?

- Fulcrum Digital - Making AI Work in Insurance: The Cultural Levers That Matter

- Kellton Tech - Agentic AI in Insurance Claims Processing

- Klearstack - What is Straight Through Processing in Insurance?

- Los Angeles Times - Fighting a Health Insurance Denial: Here Are 7 Tips to Help

- AppInventiv - Automation in Insurance

- MHC Automation - Automated Document Processing for Insurance

- MoldStud - Transforming Insurance: How Cloud Technology Revolutionizes Claim Processing

- Nous Infosystems - Strategic Role of AI in Claims Management

- AIMultiple - Claims Processing with AI Agents

- Smartdev - Use Cases for AI in the Insurance Sector

- FuelBanc - Streamlining Your Executive Role: How an Insurance Agency in Akron Can Support